Following a decade-plus of generally rising markets, a meaningful downturn in stocks has unfortunately arrived. We don’t know how bad it will be or how long it will last. We do know that without advice, investors will make costly mistakes. We’ve seen 13 corrections and 8 bear markets in global equities in the last 40 years. That’s about one every other year…So hang in there. This too shall pass.

What is the Bull and the Bear? Two formidable creatures and images of strength and ferocity. The characteristics of each of the animals are often used to describe the behavior of the market.

A Bear Market describes a prolonged downturn; named for the bear’s lethal attack method of striking downwards with his powerful paws. The bull, on the other hand, strikes his opponent with his horns, sending it upwards. Therefore a Bull Market describes steady upward movement in the market. Moreover, the bull inspires optimism, and a desire to invest heavily. But the bear is a lumbering figure, gorging himself, and then preparing for hibernation.

There is a lot of important information to be gained from studying both the bears and the bulls in the market place. One important thing to remember is that bears happen to good stocks too. So, let’s have a look at what is going on in these markets.

Basics of a Bull

- A bull market occurs when markets shares rise continuously.

- The increase is measured at about 20% on top of the recovery from the low of the bear market.

- To profit off bull markets, traders use strategies like increased buy and hold and retracement.

Basics of a Bear

- Bear markets see a fall of 20% or more

- The drop increases pessimism and negative investor sentiments

- Bear markets can be cyclical, which means they are shorter lived following a bubble burst.

- Bears can be secular, which means that they last for many years or several decades.

- Strategies for investors to manage bear markets are short selling or put options.

In some ways, bulls and bears are two sides of the same coin, as they tend to follow one another, each taking their turn. A bull market is often the result of economic expansion and optimism in the markets as a whole. While bears are part of the contraction that follows peaks and bubbles in the market. Both animals have their rightful place in the market. They are a reminder of the inevitable highs and lows of the stock market.

What history tells us about bear markets?

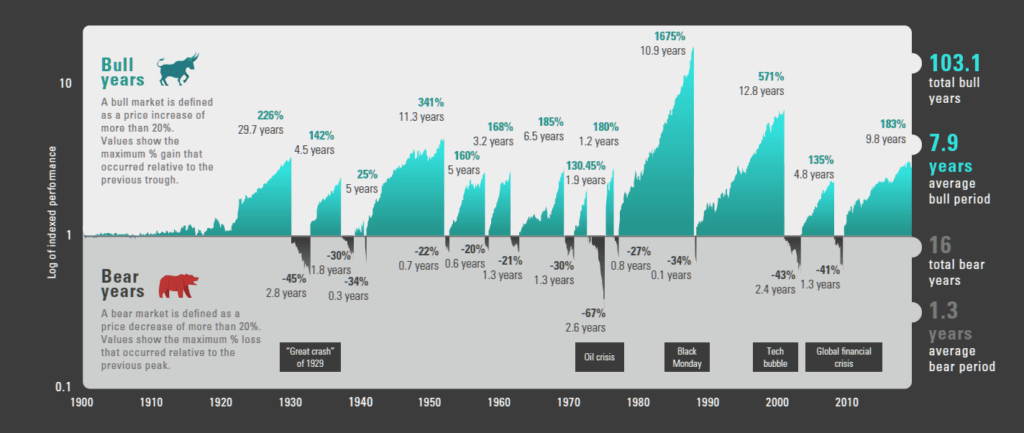

Hang In there, the average time period for a bear market is 1.3 years vs 7.9 years bull markets.

Our 1stFF team are offering meetings over the phone and will be contactable via our mobiles please email info@1stff.co.uk for details.