Mortgage repayments take up almost 40% of people’s average take-home pay

According to recent data, the number of mortgage applications has not declined despite interest rates rising to the highest level in 15 years[1]. However, the data has highlighted a sharp increase in borrowing costs, likely impacting activity in the housing market.

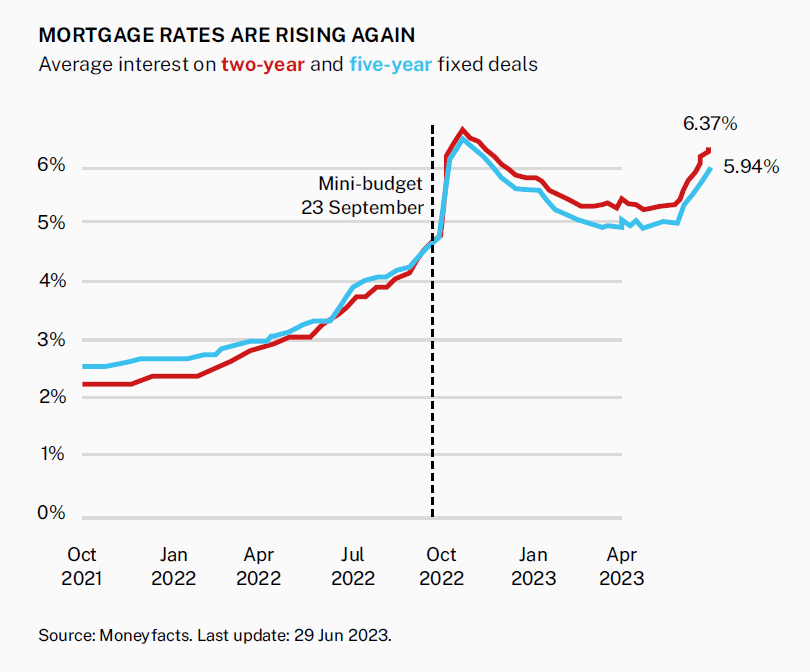

As a result of the recent economic climate, house prices dropped 3.5% in the year to June, the most significant fall since 2009. The Bank of England has raised interest rates to slow inflation. At the time of writing, the latest Bank of England base rate is 5.00%. This is an increase of 0.50%, announced by the Bank of England (BoE) on 22 June 2023.

According to the research, the data shows mortgage repayments are now taking up almost 40% of people’s average take-home pay compared to 30% previously. Although the cost of borrowing money over longer terms had risen, it has yet to have the same negative impact on sentiment, the research highlights.

Mortgage approvals increased

Figures from the Bank of England showed that despite higher rates for mortgage deals, approvals increased from 49,000 in April to 50,500 in May. Approvals for remortgaging also rose from 32,500 to 33,600 during the same period.

The current impact of higher interest rates on mortgage holders is more gradual compared to previous times, as most homeowners are on fixed rate deals. Only 15% of mortgage holders are on deals linked to variable rates, compared to 70% 20 years ago. 85% of the outstanding mortgages are fixed, but 400,000 fixed rate borrowers could be looking for alternative refinancing over the next quarter.

Mortgage rates falling

With mortgage rates reaching 6% for a two-year deal, the research highlights that the typical monthly payment could rise by £385. When applying for a mortgage, borrowers were previously stress-tested at interest rates above those prevailing today to ensure they could cope with such an increase. Even so, this still represents a significant increase.

New rules will mean some people can temporarily change their mortgage to get them through the next six months. However, there will be those who plan to sell. Many experts still hope that inflation could ease and lead to mortgage rates falling.

Time to obtain professional expert mortgage advice?

If you are coming to the end of a fixed rate mortgage scheme and would like to review your options, please speak to us for professional expert mortgage advice. Contact 1st Financial Foundations – telephone 01908 523 420 – email info@1stff.co.uk.

Source data:

[1] Nationwide Building Society 30/06/23.